Case Study: Improving Spending Control Measures

By Grainger Editorial Staff 6/27/17

A metal recycling company's spending-control measures simply weren't working.

The Issue

The process this worldwide metal recycling company set in place to control spending wasn't working. The process not only drove up spending, but caused a tremendous amount of rework in both procurement and accounts payable. Invoices were arriving before purchase orders were even approved. The controls that were put in place were actually hindering their process. In short, what they were doing wasn't working and employees were down, stressed, overwhelmed and not hopeful things could change.

Opportunity Goals

- Improve procurement efficiencies that will help improve productivity and allow employees to devote themselves to other priorities.

- Significantly help reduce the added costs associated with an antiquated and ineffective procurement process.

Key Observations and Findings

- The Approach

- Document every step of the purchasing process from start to finish. Get input from everyone from a maintenance technician to the President and CFO of the NE region.

- What Was Learned

- Due to three layers of approvals, all the way up to the regional president on every single order, employees were creating loopholes to get product into the facility. And with good reason—end users couldn't get the product they needed to do their jobs well.

- Orders were getting placed as an "emergency" or against an open account and reconciled after the PO had been approved. The largest problem arose when invoices would arrive and the POs still hadn't been approved to order the product. In some cases, the product had already been purchased and delivered—and in some cases, used.

- This "emergency" approach caused headaches for procurement and their attempts to get end users what they needed in a timely fashion. It also created a bottleneck on the accounts payable side of the business because of a slew of open invoices.

- Paper invoices were stacked up, and accounts payable employees were bringing home their work every night and on some weekends. Additional work was also created when procurement had to research a justification for orders not approved by leadership that had already been purchased.

- What Was Shared

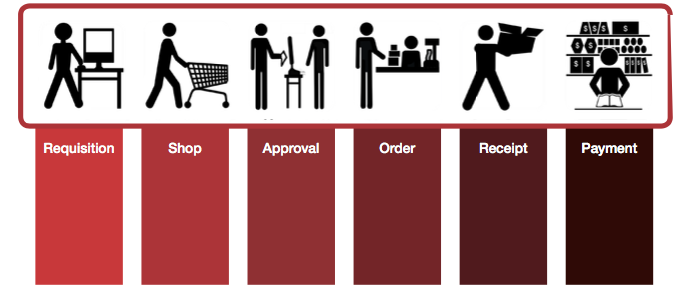

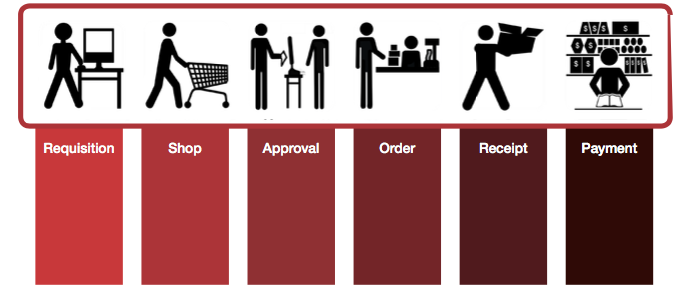

- The amount of time it took for each step of the procurement process was documented to identify areas where they were losing time and money. Those results were then compared to a traditional procurement process (illustrated below):

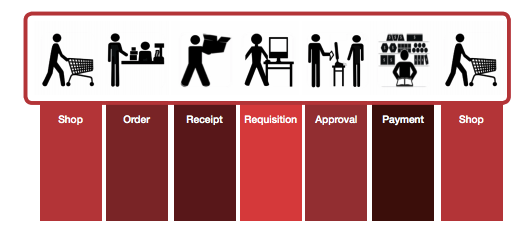

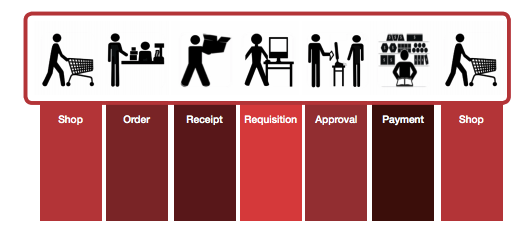

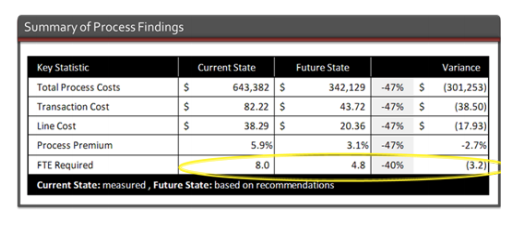

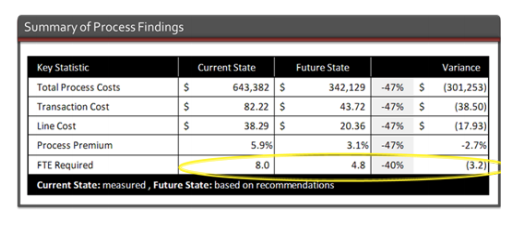

Unfortunately, the customer's process followed a more cumbersome flow, illustrated below, costing them an additional $38.50 per transaction. Some steps causing additional costs were receiving the product before the requisition was created along with duplicate shopping on the back end to justify purchases.

The process summary showed that each transaction cost $82.22 and took eight full-time equivalents just to procure materials for the NE region. Through better allocation of resources and process improvements, this company was able to bring their transactional cost down to $43.72 with just 4.8 full-time equivalents.

Recommendations and Impact

- Over the next three years, the following recommendations were put into action by the customer to drive savings.

- By setting approval limits for three different approval levels, they were able to save up to two weeks of cycle time and eliminate the need for a loophole to get daily orders placed, as well as ease leaderships concerns. This not only saved time and money for the company but also helped create an empowered workforce. Their invoice before purchase order cost dropped from 43.6% to 5.58%.

- By creating a "Maverick" spend account for miscellaneous purchases, the company was able to hold managers accountable for use of the account through monthly reporting. This also created more freedom to put orders through easily. Also, the use of blanket purchase orders for common purchases and services reduced the cycle time to process orders and ease the burden on procurement because the blanket purchase orders were pre-approved.

- On the accounts payable side, the company consolidated its summary billing for accounts payable. More importantly, they made the shift to electronically-issued invoices to reduce the paper trail and provide one central inbox for the region's accounts payable department. Through these improvements, the company was able to achieve 98% electronic invoicing and change entirely over to ACH electronic payments.

The Impact

These actions saved the customer over $340,000 in process savings—the equivalent to 4.6 full-time equivalents. Those resources can now focus on more productive activities like contract implementation, capital projects and setting up preventative programs.

The information contained in this article is intended for general information purposes only and is based on information available as of the initial date of publication. No representation is made that the information or references are complete or remain current. This article is not a substitute for review of current applicable government regulations, industry standards, or other standards specific to your business and/or activities and should not be construed as legal advice or opinion. Readers with specific questions should refer to the applicable standards or consult with an attorney.